IATA has revised its expectations for air cargo revenues and yields downward for the year due to increased capacity and a weak demand outlook.

In its latest airline profitability report, the association predicts a decrease in cargo revenues by 31.3% compared to last year, amounting to US$142.3 billion, which falls short of the previously anticipated US$149.4 billion.

Furthermore, cargo yields are projected to decline by 28.6% compared to last year, worse than the 23% decline predicted by IATA in April during the World Cargo Symposium.

IATA attributed the negative impact on yields to two main factors: the expansion of passenger capacity, which increases available belly capacity for cargo, and the potential adverse effects of economic measures aimed at combating inflation on international trade.

However, it is worth noting that both revenues and yields remain significantly higher than pre-Covid levels. According to figures provided by IATA, cargo revenues were US$100.8 billion in 2019, US$140.4 billion in 2020, US$210 billion in 2021, and US$207 billion last year. Yields experienced a growth of 54.7% in 2020, 25.9% in 2021, and 7.4% in 2022.

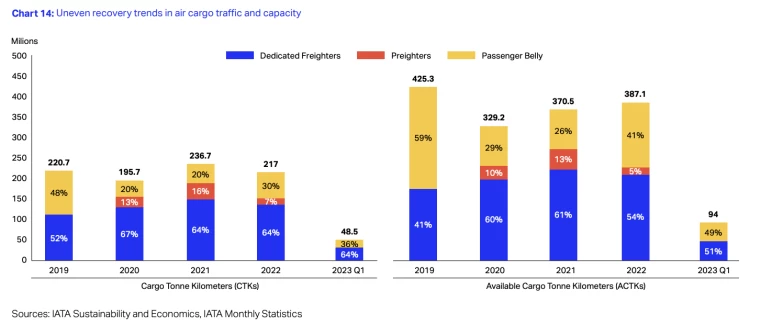

Despite these positive trends, cargo traffic in terms of cargo tonne km is expected to decline by 3.8% compared to last year and 5.5% compared to 2019.

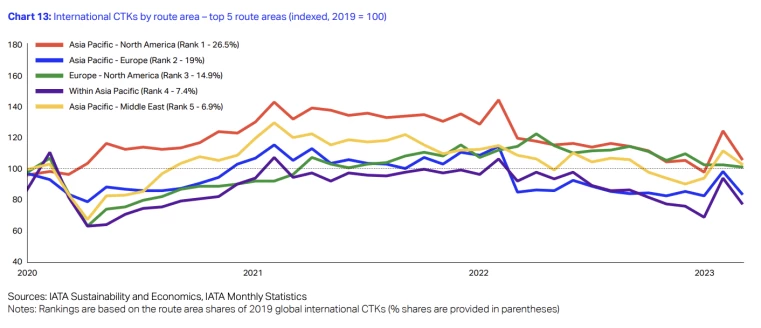

IATA noted that since March 2022, cargo tonnages have witnessed year-on-year declines for 13 consecutive months, while capacity has been steadily increasing due to the resumption of passenger operations.

"One of the main drivers behind the growth in available cargo tonne km (ACTKs) has been the recovery in bellyhold capacity as passenger aircraft return to service in various markets," IATA said.

However, global capacity has not yet reached pre-Covid levels, with seasonally adjusted ACTKs in Q1 2023 being 6.4% lower than in Q1 2019, according to IATA.

Lower ocean freight rates have also impacted air cargo revenues, as cargo has shifted back to container shipping after the initial surge in air cargo due to the Covid-19 pandemic.

Despite the challenges faced by the cargo market, IATA has doubled its net profit forecast for the overall airline industry, projecting a net profit of US$9.8 billion for this year.

The trade association of airlines noted that the increased profitability is attributed to several positive developments, including the early lifting of Covid-19 restrictions in China, sustained cargo revenues above pre-pandemic levels, albeit with lower volumes, and some relief on the cost side, particularly due to the moderation of jet fuel prices in the first half of the year, although they remain high.

"Airline financial performance in 2023 is beating expectations. Stronger profitability is supported by several positive developments. China lifted COVID-19 restrictions earlier in the year than anticipated," said Willie Walsh, IATA's Director General.

"Cargo revenues remain above pre-pandemic levels even though volumes have not. And, on the cost side, there is some relief. Jet fuel prices, although still high, have moderated over the first half of the year," he added.

Meanwhile, the IATA Director General said priorities for 2023 include SAF production incentives to accelerate progress toward net zero carbon emissions, ensuring the integrity of CORSIA as the economic measure applied to international aviation, eliminating inefficiencies in air traffic management and applying global standards consistently.

"Resilience is the story of the day, and there are many good reasons for optimism," Walsh said. "Achieving profitability at an industry level after the depths of the COVID-19 crisis opens up much potential for airlines to reward investors, fund sustainability, and invest in efficiencies to connect the world even more effectively."

"That's a big 'to do' list to achieve with just a 1.2% net profit margin. That's why we call on governments to keep their focus on initiatives that will strengthen safe, sustainable, efficient, and profitable connectivity," he added.