OCEAN CARRIERS' Q4 2022 EBIT DROPS 46% Y/Y TO US$15B

06 April 2023 |

Sea-Intelligence said even though the shipping lines recorded an EBIT of US$138 billion — less CMA CGM (which did not publish EBIT), PIL (have not published FY accounts), and MSC (privately held) — for FY 2022, there were "visible indications" of a weakening market.

The provider of research and analysis, data services, and advisory services, noted that this was confirmed by the Q4 2022 financial and volume data published by the shipping lines.

"While all of the shipping lines have remained profitable in 2022-Q4, there was a significant disparity between the larger and smaller shipping lines, with none of them able to grow their EBIT," said Alan Murphy, CEO, Sea-Intelligence.

He noted that five shipping lines recorded a Y/Y EBIT decline of US$1 billion-US$2 billion, and three carriers recorded an EBIT decline of over US$2 billion.

In fact, Murphy said Y/Y, the combined EBIT decline was a staggering -46%.

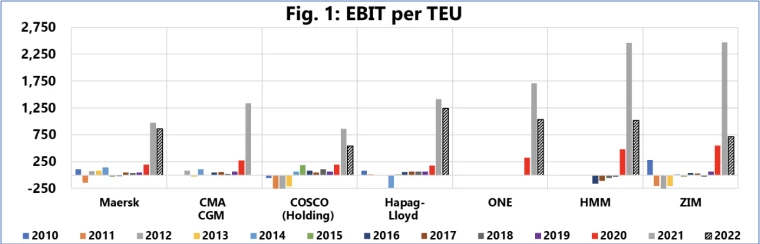

"This is also quite evident when we look at EBIT/TEU," the Sea-Intelligence chief added.

"While the largest carriers managed to maintain EBIT/TEU levels close to those of 2021-Q4, the smaller lines were not able to repeat the windfalls seen a year earlier."

The Sea-Intelligence report said on average, the carriers recorded EBIT/TEU of US$843/TEU in 2022-Q4, down 33% from 2021-Q4's US$1,252/TEU, but still vastly above the just US$17.6/TEU on average in 2010-2019.

"To add to that, there has been a strong Y/Y volume decline on both Transpacific and Asia-Europe, whereas on a global level, apart from HMM, the remaining reporting carriers have all recorded varying degrees of volume contraction," Murphy said.

"In the case of HMM, they have disrupted the market to some extent with an 8% growth in volume Y/Y," he added.