Sea Intelligence said ocean carriers recorded a "staggering" EBIT decline in the first quarter of 2023 — although numbers are still elevated compared to pre-pandemic numbers reported by shipping lines.

"There were indications of a weakness in the market in the second half of 2022, which has manifested fully in 2023-Q1," the maritime consultancy firm said.

It noted that for the January-March period, revenues declined "quite sharply," in the range of 35%-70% year-on-year.

"In terms of EBIT, there was a stark difference for 2023-Q1 versus the previous two years," it added, noting that overall, Q1 2023 EBIT reached US$7 billion versus a staggering US$43.93 billion in the first quarter of 2022.

Sea Intelligence said this is even lower than the US$16.28 billion EBIT seen during the first quarter of 2021.

"That said, it is still markedly higher than the US$621 million EBIT of 2019-Q1," said Alan Murphy, CEO of Sea Intelligence.

"In fact, the combined EBIT drop Y/Y was a staggering -81.0% (across the same set of carriers)," he added.

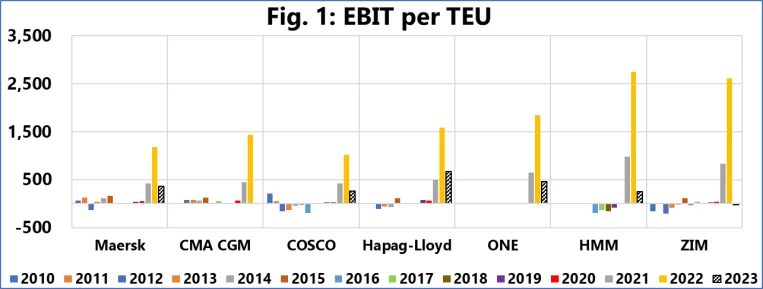

Sea Intelligence noted that this could also be seen in the EBIT/TEU figures, where none of the shipping lines was able to sustain their 2022-Q1 EBIT/TEU figures into 2023.

It said on average, the shipping lines recorded EBIT/TEU of 330 USD/TEU in 2023-Q1, down 81% from 2022-Q1’s average of 1,829 USD/TEU, but still vastly above the just US$53/TEU average of 2010-2021.

"The only silver lining, if you can even call it that, is that while Y/Y comparisons with 2022-Q1 will show a horrifying picture due to the unnaturally high numbers in that year, the reality is that the profitability of the shipping lines has increased considerably compared to the pre-pandemic levels, and looking at the current market indicators, it does not seem that the shipping lines are going to drop back down to those low levels in the short term," Murphy said.