Market intelligence company, Freightos, said some projections are still showing that the shipping industry is heading for a recovery of volumes in time for peak season this year despite current challenges.

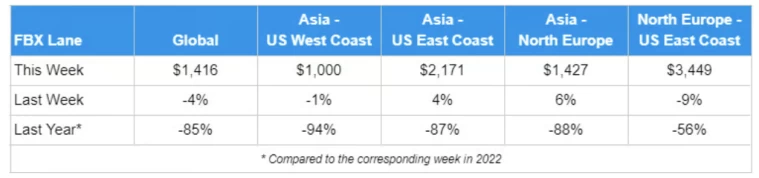

Freightos noted that the latest National Retail Federation (NRF) US ocean import data estimate that March volumes were nearly 30% lower than a year ago, reflected in transpacific rates that are about 90% lower than a year ago and well below 2019 levels.

It added that the persisting ILWU actions — the sharpest escalation in this dispute so far — shut down the ports of LA/Long Beach Thursday night and Friday, and slowed operations on Monday.

Freightos said prolonged steps like these could cause some West Coast congestion and delays, but the significant shift of volumes to the East Coast since last summer in anticipation of labour disruptions could mitigate the impact of these delays or any rise in rates to the West Coast for many importers.

"Asia-Mediterranean ocean prices, which were falling more slowly than Asia-Europe rates for much of this year, decreased by more than 40% since early March and, at about US$2,300/FEU, are nearly on par with 2019 prices," the report said.

It added that rates for all major trade lanes ex-Asia are likely reaching their floor — with Asia-US East Coast and Asia -Europe rates ticking up last week — as carriers have increased steps to reduce capacity and many transpacific and Asia - Europe ships are now reportedly sailing nearly full.

"Though Hapag Lloyd's announcement of a significant ex-Asia GRI planned for May is likely more a sign of confidence in these capacity reductions than of expectations for an imminent rebound — and though there are plenty of indications to the contrary — there are still signs that the industry is heading for a recovery of volumes in time for peak season this year," Freightos said.

In addition to recent indications of strength in the container ship charter market, which show carriers are preparing for an increase in demand, the market intelligence company noted that NRF's March estimations — though well below last year's mark — are 8% higher than in February and 4% higher than in March 2019.

"Projections for month-on-month increases at least through August, with volumes in each of those months expected to be higher than their 2019 counterparts, likewise suggest the rebound has already gradually begun and will continue into H2," Freightos said.