March air cargo decline was the ‘least-worst’ for 6 months, and revenues are still high in historical terms, according to preliminary WorldACD figures for March.

The latest report from the air cargo market data provider indicates that demand and pricing "may be stabilising," with rates holding firm and year-on-year tonnages down just -8%, compared with -13% for Q4 2022 and -11% expected for Q1 2023 as a whole.

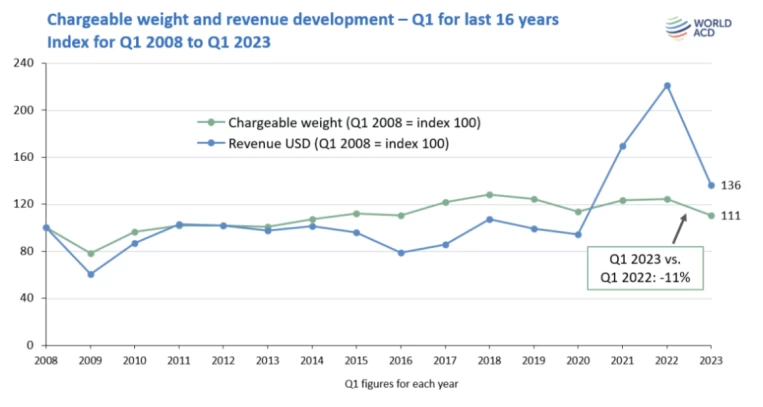

And despite the market softening in the last 12 months, WorldACD analysis revealed that early 2023 worldwide revenues remain the third-highest in the last 15 years, and rates are around 50% above pre-Covid levels.

"Preliminary figures for March indicate that global air cargo demand and pricing may start to stabilise, with average rates holding firm at around 50% above pre-Covid levels and year-on-year (YoY) tonnages down just -8% in March – compared with double-digit percentage declines in the final quarter (Q4) of 2022 and in early 2023," WorldACD Market Data showed.

Initial WorldACD figures indicate that Q1 2023 is looking at a -11% YoY drop in tonnages, compared with -13% for Q4 2022, with March's -8% YoY decline pointing towards a deceleration of the recent pattern of YoY volume decline.

"And despite softening in the last 12 months from the exceptionally high demand and pricing levels the previous year, the international air cargo market remains relatively strong in historical terms, with early 2023 worldwide revenues still the third-highest achieved in the last 15 years," the analysis added.

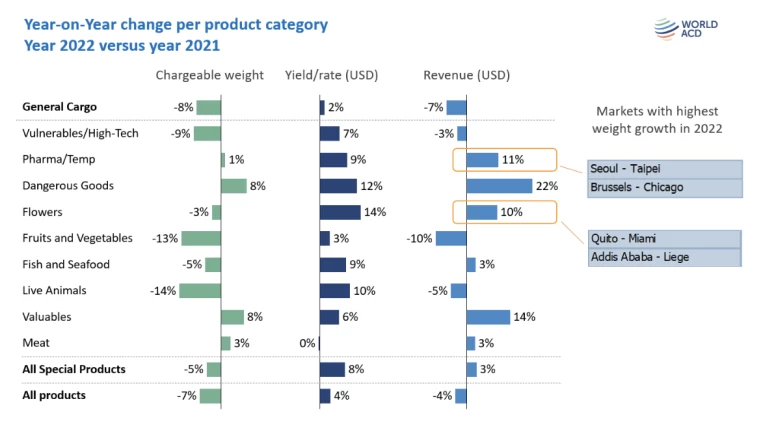

It also reveals continued revenue growth within air cargo specialist products, including temperature-controlled/pharma, dangerous goods, flowers, meat, and live animal shipments, with specialist products continuing to grow in importance and in revenue terms for carriers and the wider air freight sector.

Revenues still at near-record levels

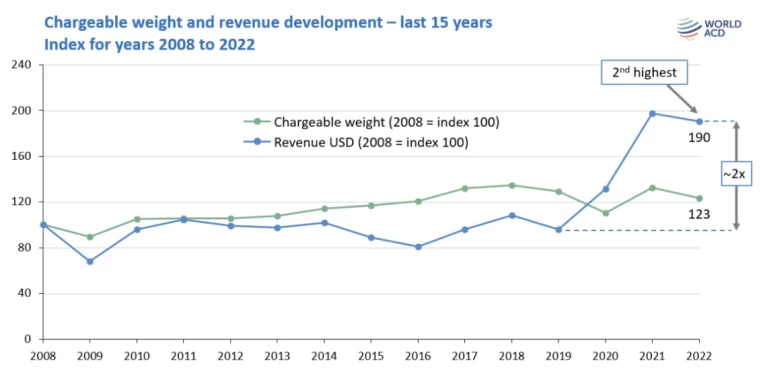

WorldACD said although worldwide air freight tonnages and average yields have been on a generally declining trend since last March, its analysis show that worldwide air freight revenues last year were at their second-highest level in that 15-year period, just slightly below their record levels in 2021 and around twice their average annual level in the decade before the Covid pandemic.

And on the demand side, tonnages in 2022 were on par with those in 2016 and higher than in any of the years leading up to 2016.

Figures from WorldACD also show that air cargo tonnages have experienced monthly year-on-year declines since March 2022 from their elevated levels in late 2021 and early 2022, and average rates have been falling since September, although there are some early indications that demand and pricing may be stabilising.

WorldACD said average yields, including surcharges, appear to have stabilised since December at around -29% below their historically elevated levels the previous year and still substantially above their pre-Covid levels.

"Freight forwarding and shipper reports suggest that this may partly reflect an adjustment of inventory levels following restocking that took place in early 2022 in response to congestion and anticipated congestion in ocean freight supply chains, plus softer and unpredictable consumer demand in some sectors," it said.

"Various sources believe the current relatively subdued demand will continue during the first half of this year and that demand levels may pick up in the second half of 2023 as inventory levels drop," WorldACD further said.

In the meantime, analysis by WorldACD highlighted several areas of continued tonnage or revenue growth.

It said that, for example, a breakdown of air cargo product categories for February 2023 by WorldACD indicates that while general cargo tonnages were down -14%, year-on-year, overall volumes of the 12 special products categories tracked by WorldACD were up by +1% — and gives special products, currently, a 36% share of the overall air freight market, compared with 33% in 2019.

Among those categories, vulnerable/high-tech products saw a +4% increase in February, live animals a +12% increase, and valuables a +3% increase in chargeable weight compared with the equivalent period last year.

WorldACD said pharma/temperature-controlled products saw revenue grow +11% in 2022, mainly due to +9% higher yields.

Dangerous goods saw revenues rise +22%, year-on-year, thanks to growth in both chargeable weight (+8%) and yield (+12%).

Revenue from flower shipments rose 10%, despite a -3% drop in volumes, thanks to rates rising +14%, and revenues for general cargo shipments declined by -7%, year-on-year, with volumes declined by -8% and yields more or less flat at +2%.