Rent in logistics warehouses across Asia-Pacific is expected to rise 3%-5% this year amid continued strong demand boosted by recovery in global trade flows.

Independent global property consultancy firm, Knight Frank, said in its latest Asia-Pacific Warehouse Review for H2 2021 that "17 out of the 17 markets" that the company tracks across the APAC region saw stable or increasing rental in 2022 or a "marginal increase" of 0.5% year-on-year.

It said vacancies are also expected to remain tight on strong demand and active pre-commitments.

"The emergence of the Omicron variant late into 2021 created fresh headwinds for the region. While it has put pressure on supply chains in the short term and constrained trade, which has been a vital engine of growth, it is unlikely to detract from the long-term structural fundamentals that logistics markets in the Asia Pacific enjoy," said Tim Armstrong, global head of occupier strategy & solutions, Knight Frank.

He noted that the current momentum "indicates that demand from occupiers in the region still has ample room to run."

"Rents are tipped for further growth in 2022 but will be challenged by occupiers' cost sensitivity in certain sectors. The supply imbalance in the region, however, will continually tilt markets in landlords’ favour," Armstrong added.

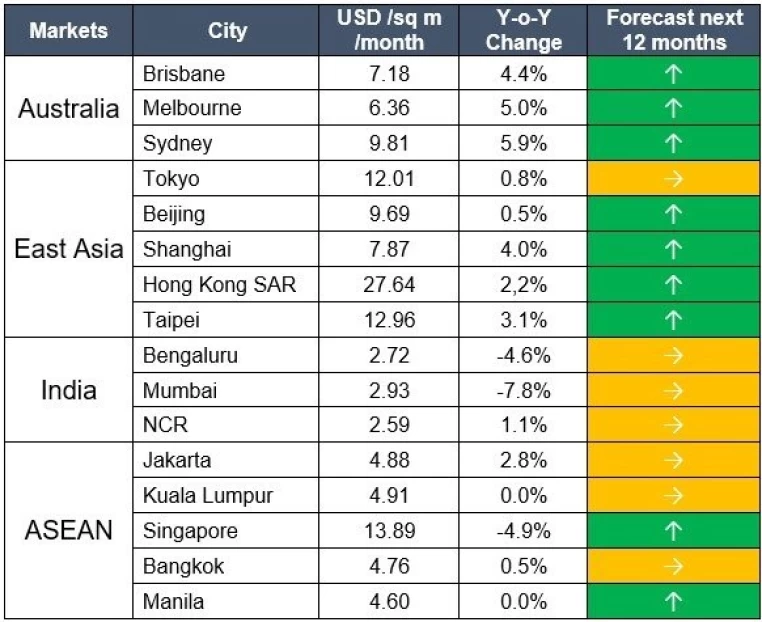

The Knight Frank report showed that warehouse rent prices in major APAC cities are forecasted to rise in the next 12 months including in Melbourne, Sydney, Brisbane, Beijing, Shanghai, Hong Kong, Taipei, Singapore and Manila.

Asia-Pacific Prime Warehouse Rents H2 2022

Knight Frank noted that in particular, Australia's prime warehouse rents on its Eastern Seaboard posted the highest increases in the region with a 5.9% year-on-year growth for Sydney.

Meanwhile, rents in Shanghai and Beijing are expected to remain on a gradual uptrend in 2022.

"Take-up in the region's warehouse markets remained robust in the second half of 2021, lifted by resurgent trade flows from the recovery in global demand. As a result, rents for logistics warehouses across Asia-Pacific rose by a marginal 0.5% year-on-year in the same period," said Christine Li, head of research, Knight Frank Asia-Pacific.

"Despite close to 9 million sqm of new supply expected to be delivered in the region in 2022, vacancies are likely to remain tight on strong demand and active pre-commitments."

Li noted that the warehousing sector is also getting a boost from the surge in e-commerce demand across the region — although further expansion will need more macroeconomic boost.

"While logistics warehouses have benefitted from powerful e-commerce tailwinds, at some point, further growth will have to be sustained by macroeconomic stability in consumption and investment," Li added. "As a result, the outlook for the logistics sector in 2022 is bifurcated between the developed and emerging markets."

(35)-x-large.webp)