The East coast ports in the United States (US) have become more attractive to shippers importing from the Far East as congestion on the west coast intensified, according to the recent report of ocean and air freight rate benchmarking and market analytics platform, Xeneta.

In a statement, it added that premiums to the US East Coast and Midwest rail ramps have also seen an increase compared to the West Coast.

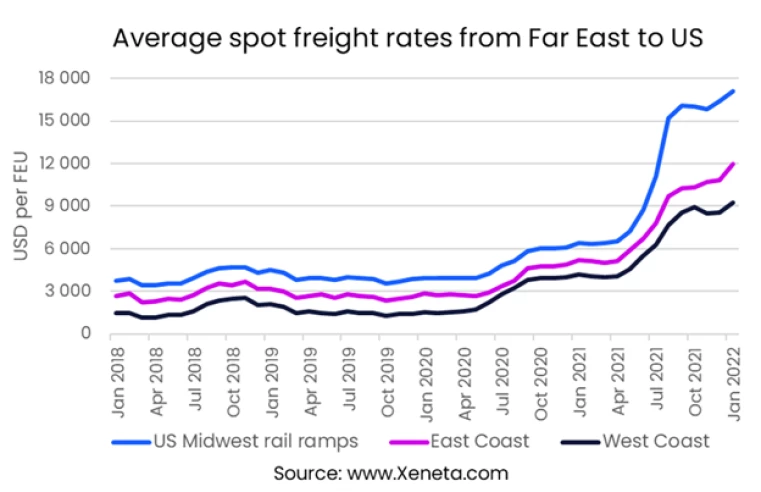

"The relationship between freight rates going from the Far East to the USEC, USWC and Midwestern rail ramps have followed each other closely. There has been a relatively stable premium for sailing to the East coast rather than the West Coast and getting to the midwestern ramps," Xeneta said.

"However, as extreme market conditions have taken over in the past twelve months, the relationship between these three sets of rates has changed."

It said the premium between the USEC compared to USWC has widened. In 2018 and 2019, it cost an average of US$1,150 per FEU more to send a 40” container to the east coast but on January 24, 2021, the premium stood at more than double that level at US$ 2,750 per FEU.

Shippers opting for US East Coast ports

"Despite the higher price and longer sailing distance, the East coast has become more attractive to shippers importing from the Far East as congestion on the west coast intensified," Xeneta said. "Sailing into the east coast allows a shipper to avoid the choke points on the west coast."

It added that although port congestion and delays are also a problem on the east coast, there are more hinterland options to choose between and shorter distances to cover on clogged-up networks than the relatively few options offered on the west coast.

Xeneta further said that although freight rates to the seaports have increased dramatically, those to Midwest rail ramps have done so even more, as the price of US inland transport has also gone up.

"Very few transport providers have been able to escape the disruptions of the pandemic and keep up with the strong demand. Moreover, the intermodal nature of global container transports means that collaboration along the supply chain is paramount in order to move the goods in a most efficient manner," it added.

On January 24, Xeneta said the average rate from the Far East to the Midwest was US$ 17, 250 per FEU, a 167% increase compared to January 2021.

A slightly smaller but still a big jump on the long-term market has left rates at US$8,588 in January 2022.

(17)-x-large.webp)