Global air cargo tonnages continued to soften in the last two weeks, with average global rates also dipping slightly last week, amid a broader pattern of overall tonnage and yield stabilization on a slight and slow downward trajectory, according to a new WorldACD analysis.

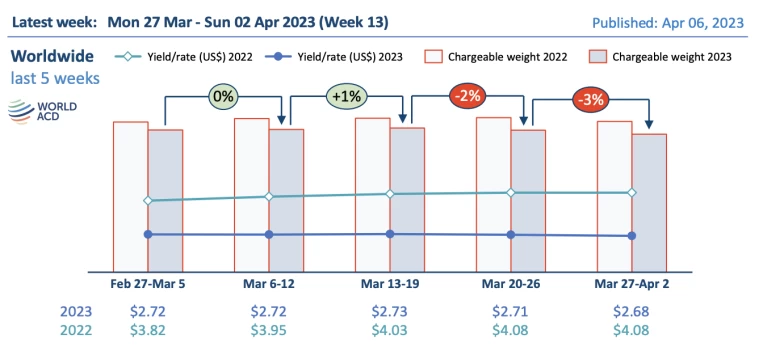

The latest report from the air cargo market data provider noted that comparing weeks 12 and 13 with the preceding two weeks (2Wo2W), overall tonnages decreased by -2% versus their combined total in weeks 10 and 11, and average worldwide rates decreased by -1%, with capacity more or less stable.

The data is based on the more than 400,000 weekly transactions covered by WorldACD's data.

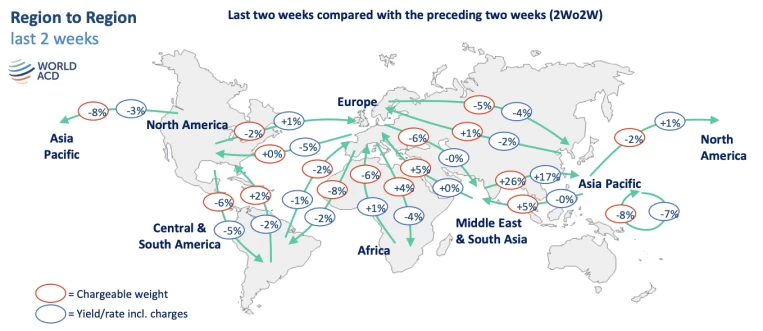

"At a regional level, the weakening development in air cargo tonnages continues between various markets, on a 2Wo2W basis, particularly flows ex-North America to Asia Pacific (-8%) and to Central & South America (-6%), and flows ex-Europe to Central & South America (-8%) and to Middle East & South Asia (-5%)," it said.

WorldACD noted that demand on the big lanes from Asia Pacific to North America and Europe remained "broadly stable," while notable increases were recorded on the flows between the Middle East & South Asia and Asia Pacific (eastbound +26%, westbound +5%).

Average rates also continued to show a stable trend on a 2Wo2W basis for Asia Pacific, and an increase for Middle East & South Asia (+2%).

It added, however, that for all other regions, the average rates are declining.

Year-on-year comparison

WorldACD said comparing the overall global market with this time last year, chargeable weight in weeks 12 and 13 was down -8% compared with the equivalent period last year, consistent with an average -8% year-on-year decline recorded throughout March.

Rates 50% higher than pre-Covid levels

It said notable percentage decreases in tonnages year-on-year were ex-North America (-24%), ex-Europe (-7%), ex-Middle East & South Asia (-7%). Also, ex-Asia Pacific the trend compared to last year was negative (-4%), despite recent positive developments from that region.

Overall capacity has jumped by +12% compared with the previous year, with double-digit percentage increases from almost all regions, except Central & South America, and North America — with most-notable increases seen ex-Asia Pacific (+25%), ex-Africa (+18%) and ex-Europe (+13%).

The report noted that worldwide rates are currently -34% below their levels this time last year, at an average of US$2.68 per kilo in week 13, despite the effects of higher fuel surcharges, but they remain significantly (+50%) above pre-Covid levels.